What We Provide

Our process always starts with a conversation to learn about you, your goals, past investment experience, and attitude towards risk. This is done to assess your general financial situation, to figure out all the levers you have to shape your finances toward your goals, and to choose the portfolio that best fits your needs. This conversation continues over time so we can plan and invest toward your evolving goals. We also go through a financial planning process with our clients to help them see the impact of various life changes they are considering.

In addition, our clients have access to the important resources of the Schwab advisor services. This set of third party providers, carefully screened by Schwab, covers a wide range of specialist firms: Trusts, Insurance, tax support, wealth transmission. We can refer to you the appropriate resources to solve your problems.

We aim to bring clarity, planning and efficient investing to help you reach your goals. Our portfolio design algorithm and our proprietary financial planning approach are our distinct advantages.

FINANCIAL PLANNING —

If I sell my home in the Bay area, move to Portland and retire

will my financial assets keep growing?

Designing our own tool to help you plan your financial future came from the frustration we experienced with market leading financial planning software.

We wanted a tool that would:

Let us model your current finances without the fastidious collection of cost of living data. Our tool, inspired by mass balance techniques used in chemical engineering, lets us reliably measure your overall cost of living without requiring too much info.

Give us a clear understanding of all the assumptions made in projecting the future.

Provide intuitive graphic support for each of the scenarios that our clients were contemplating.

The conversation always starts with an inventory of your assets, your debts, your present and future income, saving streams, as well as your life goals.

Our next step is to assign an inflation rate to the value of your real estate assets, living expenses, and an average future return for your financial assets. Our software then computes and graphs your future real estate, debt, and financial assets. We are then ready to consider scenarios and visually assess their impact on your assets in the future.

“If I sell my home in the Bay area, move to Portland, buy a home with a smaller mortgage and work only part time, will my financial assets keep growing or will they dwindle?”

“If I keep working five more years and postpone my social security payment, can I afford to finance the college education of my granddaughter?”

“If we sell our house in Austin and buy a more expensive home in Seattle to be near our grandchildren, how much can we expect to effectively transmit to our children?”

Our planning tool clarifies these for you.

PORTFOLIO DESIGN —

We are dedicated to using cutting edge

financial theory and data sciences.

Our Principles

We are dedicated to using cutting edge financial theories, data sciences, and optimization techniques to build a wide range of portfolios that have proven to be efficient at absorbing past market shocks. Our approach is evidence based, only past performance data are used to find optimum portfolios.

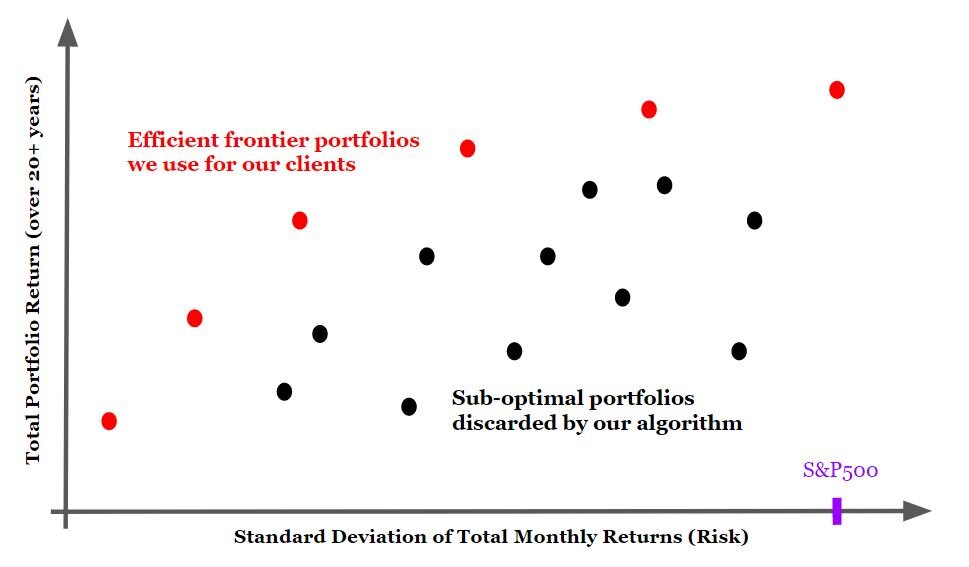

We follow Efficient Market Theory and Factors of Returns Theory, by using passive asset class funds by Dimensional Funds and other providers that emphasize known factors. Our optimization provides a family of portfolios that compose the Efficient Frontier.

Our Process

Running our algorithm is a process that starts with the collection of data. Collecting monthly returns of existing securities is rather simple, collecting monthly performance of indexes requires access to various databases. We are thankful for access to the Center for Research in Securities Prices database of University of Chicago, and for access to the Federal Reserve Economic Data database run by the St Louis Fed.

The algorithm itself is proprietary and is computationally intensive. So much so that we are forced to run it in the cloud. The product of our algorithm is a set of optimum portfolios. These portfolios vary greatly in their historic volatility. The most stable portfolios can be used for short term savings, the most volatile portfolios have a volatility comparable to that of the S&P over the same time period period, none of the portfolios we designed are riskier than that.

Our process is an evolving one. We carry out a portfolio optimization about twice a year and each time we do it, the time frame used for the optimization shifts a bit, more data needs to be collected and new asset classes can be tried. We repeat the process over time to broaden the set of asset classes that we try out and to also increase the range of market conditions represented in the time frame considered. We expect this evolutive refining to provide us with ever more insight into our portfolio design.

Our Algorithm Inputs

The input of our algorithm is the series of total monthly returns for each asset class we choose to consider for a period of 20 years or longer. If the asset class is a fund for example we need to get total monthly returns for every month. In case the fund does not have a sufficiently long history of performance we need to be able to reliably extrapolate past performance using the index that the fund is duplicating.

We purposely choose a time frame around 20 years or longer because our goal is to find portfolios that behave well over a wide range of market conditions. The past 20 years currently include three dramatic stock market crashes, each of very different nature, a variety of interest rate environments, several economic cycles.

We like to consider as broad a range of classes as we can. The broader the range the better the diversification can be. US real estate, non US real estate, US stock (with a lean on various factors of return), International, Emerging market stocks, International bonds, US corporate bonds, US treasuries (of various duration), Treasury Inflation Protected Securities, commodities; all these classes can be considered. But also, leverage, in the form of margin debt can be considered as an asset class. We can reliably extrapolate the interest of margin debt for each month of the last twenty or more years.

Our Algorithm Outputs

The output of our algorithm is an efficient frontier, a family of portfolios, each with a very specific composition of the asset classes (including margin debt) we considered as input, each providing the highest historic return at their specific volatility. This family of portfolios is, by design, offering a very broad range of historic volatility so we can cater to all sorts of risk attitudes of our clients.

It turns out that a significant contribution to that efficient frontier is the use of leverage. We share this observation with the founders of the Risk Parity approach. It is important to note that leverage in and of itself does not mean increased risk. Reasonable leverage is used here to boost returns of very stable portfolios. Actual risk is better grasped by the standard deviation of total monthly return on equity, which is the x axis of our graphs. Also note that historically none of the portfolios we use come anywhere near margin call over the past 20+ years, and that period includes three rather dramatic equity crashes. Not all accounts can implement portfolios with leverage. IRAs in particular do not allow leverage. For this reason our algorithm produces not one but two sets of portfolios, one that uses leverage and one that doesn’t.

The optimum portfolio family that includes margin debt represents a higher level of performance at any chosen volatility, a more efficient set of portfolios. We call these our Giboulées™ portfolios.

Our Giboulées™ Portfolios —

In the spring in the alps, warm bright sunshine can be interrupted abruptly by torrential rain, sleet, snow and bright sunshine again, all in the same hour. The French call these giboulées. Topsy turvy, market up, market down, chaotic disruptions. We focus on building portfolios that provide a good return and relative calm through any series of changes, these are our Giboulées™.